House Assets Mortgage Positives & Drawbacks: Is-it Best For Your Needs? When you render expenses on house loan, you’ll build assets.

Value may be the volume of your own home you’ve paid back, and it can be used as equity for even more funding. Real estate assets loan is a sure way to do that.

Identifying if this is best for you are a point of considering homes value money pluses and minuses and seeing just how those would point into your present situation.

Pros Of Residence Money Lending Products

The features of home collateral financing put those outlined below.

Advantageous rate of interest

In most cases, room money financial loans have lower interest rates than charge cards or signature loans since your residence is being used as guarantee. The reduced fee enables you to need a sizeable amount with somewhat lower complete focus.

Likewise, these financing options often have attached prices, which means your monthly installments won’t fluctuate.

Lump sum amount

Your dream house fairness mortgage brings one a lump sum transaction for any full volume the loan, which makes it useful for taking care of big spending that you know exactly what factors will definitely cost.

By contrast, other available choices instance real estate fairness loan (HELOC) don’t give you a lump sum fee.

Promising taxation value

Real estate fairness debt may are eligible for certain taxation value if this’s used to make improvements to your residence. Therefore, you’d likely be in a position to deduct the interest on the loan instalments from the nonexempt profits, possibly reducing the volume you must pay the IRS.

Ability

Ultimately, room collateral loans tend to be versatile in this particular you can use your lump sum amount for whatever you decide and desire. Obviously, that does not indicate that you should, however you possess the flexibility to work with the funds whilst you view accommodate.

Disadvantages Of Homes Fairness Financing

While a house value funding could be beneficial in the best settings, it will do get the possible drawbacks.

Extra loans

These types of downsides is probably that you are dealing with most debts. If you’re nevertheless producing home loan repayments, you’ll really have to use residence assets loan instalments in your month-to-month cost.

That could limit your capacity to borrow cash later as many financial products have got debt-to-income needs. If for example the absolute amount every month debt was above a definite proportion of your respective returns, you may not qualify for particular personal loans.

By securing your loan along with your residence as collateral, it can perhaps place your home in jeopardy. If you should default individual household assets financing, it might probably mean getting rid of your home.

Another (inclined) circumstance is actually ending up “underwater” inside financing. In the event that you have regarding your house money loan than your house is in fact well worth, it’s identified as are “underwater” or “upside-down” during the funding. This may be challenging if you want to market or borrow against your very own home’s equity down the road.

Further expenditures

Just as with lots of borrowing from the bank possibilities, household equity funding bring an entire completion process, which will indicate charges. Because of this, it is informed that you simply estimate your present spending and choices to be sure that the closing costs and charges are worth it.

Appropriate Uses For Your House Value Finance

A home assets mortgage is best put to use in the next use.

Creating renovations

Innovations that boost your home’s advantage may the best way to make use of real estate equity finance. You don’t only use appreciate (and thus even more equity) to your home, you can also are eligible for the tax value expressed above when you are performing extremely.

Handling unexpected emergency spending

Unexpected large expenses including hospital statements, house repair, and so on can often be difficult to handle without some kind of financial. Without a lot of curiosity than signature loans or financing, your dream house value money  might end up being a powerful way to undertake these expenses.

might end up being a powerful way to undertake these expenses.

Creating assets

A good investment that helps your personal future is actually simple method to work with a home money money. The actual result must always be some kind of generate, such as returns on financial money or much better revenue caused by degree.

Combining loans

Large amounts of high-interest debt can be replaced by real estate resources debt, merging it all into one payment per month at an affordable fee. When full prices associated with the loan happen to be less than the attention or issues you’d look in your recent obligations, and in case an individual qualify, real estate assets mortgage just might be an impressive solution.

If Not To Make Use Of Your Dream House Assets Money

If you can use real estate assets loan for anything at all, some purpose that aren’t beneficial add:

Put simply, make sure you obtain best the things you need and with the right objective.

Qualifying For Home Fairness Mortgage

Residence money lending products posses particular requisite, most notably those characterized in this article.

Enough value

First off, you’ll need enough collateral to cover your own expenditures. Normally, financial institutions won’t provide about 80per cent on the importance of the security, that is definitely their home’s collateral in this situation. And so, your very own credit limitation would usually get 80per cent of but the majority of your home you’re about to payed off.

Minimum credit levels

Some financial institutions get lowest borrowing amounts, and certain don’t. In any case, nearly all household money lending don’t become far lower than $10,000. Whatever quantity you ought to borrow, it should be adequate to cause a house value money.

Sufficient profit

Your revenue must be satisfactory to address the added debts you’ll feel dealing with. In case’s a shortage of, another financing alternative is much more worthwhile.

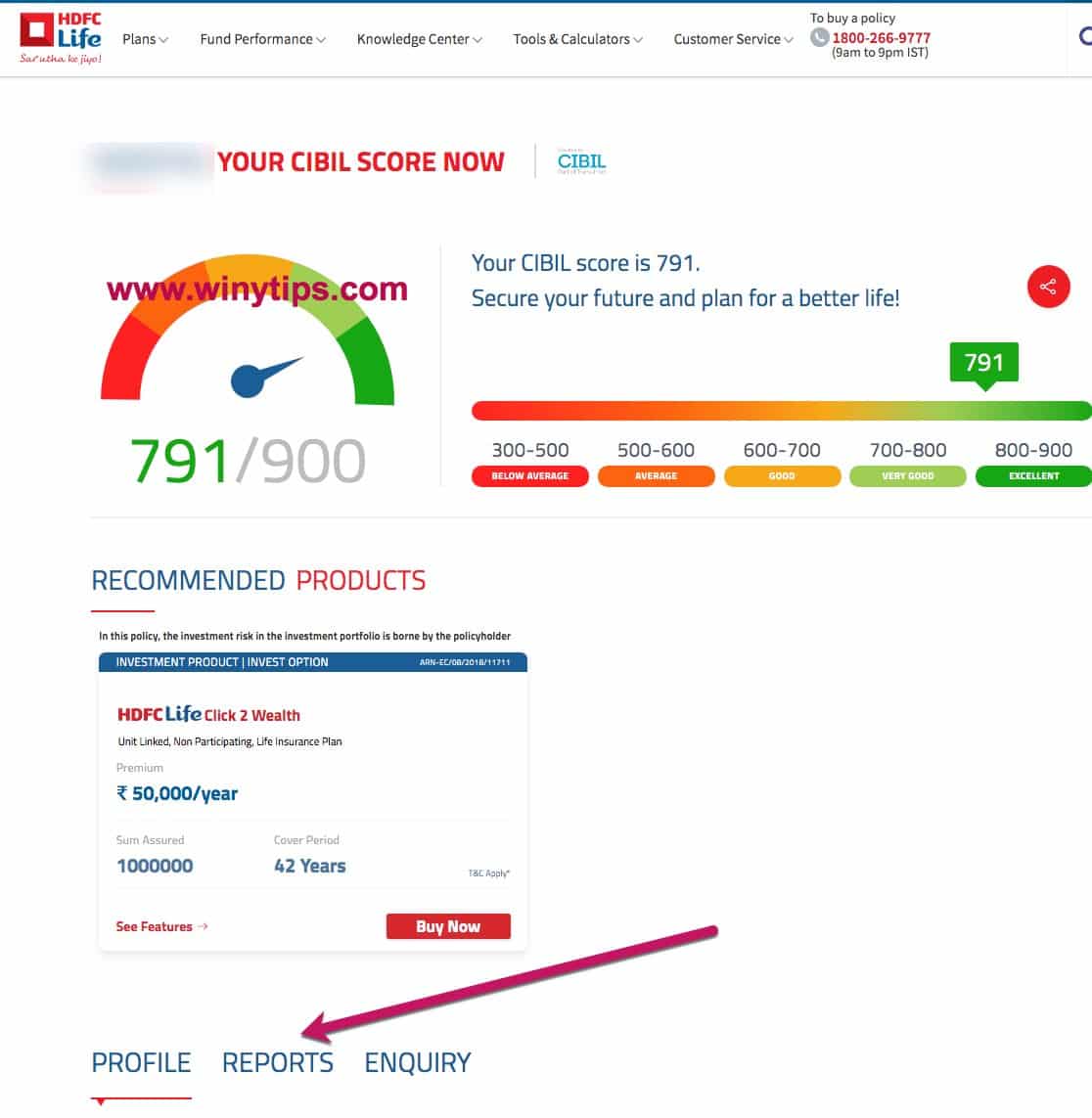

A good credit rating

Ultimately, a good credit record is preferred. Reduced credit score rating helps it be harder to have accepted, and it will surely typically lead to an improved interest.

Consult your loan provider

Eventually, to find a property equity financing, you’ll need to consult your lender. They’ll encourage you in the finest study course to consider which help you will be making appropriate purchase for the budget.

Weighing Room Equity Financing Good And Bad Points

Understanding the importance and disadvantages of house assets lending is a crucial part of making the right investment for your specific financial well-being.

At GHS FCU, we offer homes fairness financial products having same-day prequalification, aggressive charges, fast closing, plus.